How to Turn Conflicting Feedback into Market Clarity

May 11, 2022

Most companies avoid primary market research. They believe that in-house tribal knowledge is enough to make the key product and business decisions. Research would just tell the team what they already know and slow down development.

But research is actually the thing that can add the most value to an organization.

Why?

Research reduces risk.

It helps teams validate problems. If you don't have the right problem, you definitely don't have the right solution.

It helps teams understand standard of care inertia. Changing the standard of care is a heavy lift in healthcare. Gaining first-hand perspectives of patients, clinicians, administrators, operations managers, payors, regulators, and other stakeholders is the best way to understand if overcoming SOC inertia in favor of your solution is viable. Overcoming this inertia is essential to gain adoption and market traction.

It helps teams understand how a solution will be measured. Generally, this isn't about the time saved in the OR or a better grip in the surgeon's hand. It's about improved clinical outcomes and reduced healthcare costs. That's what healthcare needs, and that's what your medtech solution needs to deliver.

Risk is inversely correlated to value.

Risk is the basis of market pricing. Stocks, bonds, real estate -- higher risk equates to lower present value. The same is true of your company. By reducing risk, you increase your company's present value. Nothing new here but a critical mindset for medical product entrepreneurs to maintain.

So, if research creates so much value, why are so many companies avoiding it?

Well, obtaining reliable insights from primary research is hard.

Often, teams will get conflicting information from stakeholders. These conflicts can lead to more confusion than clarity.

So, how can you filter the signal from the noise? How can you extract the valuable market insights that will help you drive key product and business decisions?

Here are 3 quick tips to help you with this process:

1/ Prioritize observations over voices

What stakeholders tell you is less reliable than how they act.

If you are interviewing a clinician that is helping you understand the standard of care, don't just ask them about their thoughts on it. Instead, get into their lab and/or office space, and ask them to walk through operation of the equipment from beginning to end.

Carefully document each step of the process and objectively determine the ones that are most complex, prone to error, and time consuming. A clinician that has gotten used to a piece of equipment over the last 5 years is likely to minimize the difficulties associated with it. Often, users will get into 'autopilot' mode when performing a task that has become routine, and they will not see any problems with it.

Use your own observations and objective reasoning to understand the challenges associated with the standard of care and related products.

Additionally, look for workarounds.

Have care teams applied labels on pieces of equipment to remind others of common errors or missteps? Are there other pieces of equipment that are substituted for intended steps in the process? Workarounds are explicit opportunities to improve devices associated with the standard of care.

When speaking with an administrative stakeholder involved in purchasing decisions, don't just focus on the opportunity you aim to pursue. Instead, try to understand and observe how other pieces of equipment have been procured, adopted and rolled-out within the institution.

Ask for specific examples of equipment that have been purchased in the last year. How was the product originally introduced? What data was needed to support consideration? What ultimately resulted in a purchase? How was the initial product trialed? How were new team members trained? Were there follow-on purchases that occurred after usage of the initial product? How is the product being evaluated for efficacy?

By focusing on specific examples and avoiding abstract "what if" scenarios, you will gain much better insights into the buying process that will ultimately be applied your product.

2/ Link the source to the comment

When a new product is adopted, it is likely to change workflow for some individuals. It may make jobs and lives easier, or it may make them more complex, difficult, or even unnecessary.

Let's take an example:

Say there is a new device for diagnosing diabetic foot ulcers. It allows ongoing monitoring to take place in the home rather than the hospital. You want to collect stakeholder feedback to determine motivations and inhibitions related to future adoption. So, you connect with patients, doctors, nurses, and administrators.

You may receive the following feedback:

- "Ongoing monitoring at home is advantageous, since ulcers can manifest in between patient visits. Catching ulcers earlier will significantly improve patient outcomes." (Doctor)

- "I'm skeptical of the efficacy. The current standard of care methods are proven to be accurate when completed properly." (Nurses)

- "Who's going to be tracking the data? We are too busy to be tasked with monitoring data for all of our remote patients." (Nurses)

- "Using the device at home will prevent me from going to the hospital so often. Time savings is a huge benefit." (Patient)

- "Payment will be difficult. Reimbursement amount for remote monitoring is much lower than amount for on-site foot ulcer screening." (Administrator)

(Note -- the quotes and perspectives above are fabricated for the example; they are not indicative of real-world perspectives on this device category or patient population.)

It is ideal for you to get the buy-in of all stakeholders, but that may not be possible in certain situations.

In the example above, the nurses may feel that part of their value is being removed by turning a manual procedure into an automated one. Moreover, their perception of increased time and responsibility may be difficult to overcome. There are likely some legitimate concerns from the nurses.

The administrators may provide negative feedback because the new solution may result in less revenue to the hospital. If the ultimate payer is the hospital, then this perspective will be quite alarming. But if the payer is an alternative source, then this perspective may not be as critical to consider.

When you are collecting feedback, it is helpful to capture them in quote format, and attribute stakeholder groups. This will help you better understand and prioritize the perspectives so you are able to drive product and business decisions from it.

3/ Apply quantitative methods to qualitative data

For key decisions around the problem to pursue, the concept to advance, or the go-to-market strategy take an analytical approach. If you keep everything in qualitative format, it will be extremely difficult to make logical decisions. You'll be going off of gut feel that has been informed by various stakeholder perspectives. Teams often latch on to the most vivid or memorable pieces of feedback rather than the feedback that is most critical to the ultimate success of the product and business.

A better approach is to compile your qualitative research into a quantifiable format.

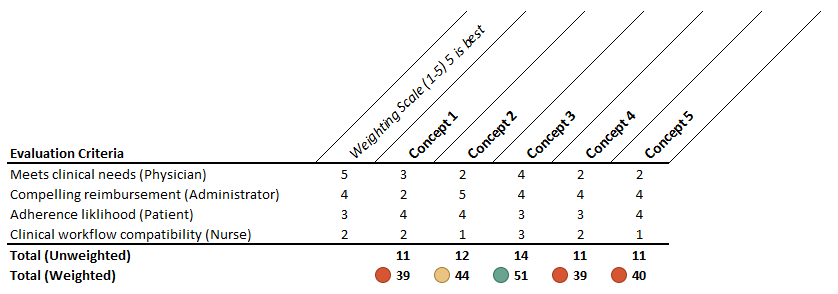

At Archimedic, we frequently use Pugh charts. Even if you haven't heard this term, you are likely familiar with the concept. A Pugh chart is a matrix that allows teams to evaluate concepts or strategies against a set of weighted criteria. Below is a snapshot of an example Pugh chart.

(If you want our template for Pugh charts, send a note to hello [at] archimedic, and we'll send ours over to you.)

A Pugh chart will help you and your team fit the various perspectives of your primary research into buckets. It also allows you to prioritize the buckets through weighting factors. For instance, in the example above, you may see that the weighting prioritizes doctors (top), patients, administrators, nurses (bottom).

When creating Pugh charts, here are a couple of details to consider:

- It's primarily a communication tool. While you are pushing qualitative insights into a quantifiable format, there's a lot of interpretation that goes into that translation. It is helpful if you use the Pugh chart more as a communication tool rather than a determinant of the final direction. One can easily steer a score toward a favored idea and use the data to suggest rational decision making. It's better though if you and your team use the Pugh chart as a debate mechanism around the weighting factors and the concept scoring. Through this dialogue you will gain deeper insights and drive alignment with your team members.

- Pugh charts aren't just for concepts. Pugh charts are great for helping teams decide on a product concept to pursue. But they are also great for helping teams determine target problems, patient populations, revenue models, payers, and more. Any time there are multiple options to consider, a Pugh chart can be a valuable tool to help you and your team logically think through the options and converge on the path that makes the most sense given the feedback and constraints.

One Last Thing..

If you take this process seriously, it will add significant value to your organization. Get out of the lab and get into the heads of your stakeholders. You will learn so much, and this process will help you and your team make smarter decisions that will ultimately optimize your chances of market adoption.

If you could use help in collecting primary market research to define your product and business strategy, reach out to us at Archimedic. We have experts on the research process and ensure that the outputs drive the right design and business decisions. Send a note to hello [at] archimedic.com, and let's explore a collaboration.

Join the conversation

Drop your email below to receive these articles delivered to your Inbox as soon as they're published.